Get Best GST Practitiner Near You

Select State

Select District

Searching

*The above data is refered from GST Portal

What is GST

The goods and services tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption. It is a destination based tax on consumption of goods and services. It is proposed to be levied at all stages right from manufacture upto final consumption with credit of taxes paid at previous stages available as set off. In a nutshell, only value addition will be taxed and burden of tax is to be borne by the final consumer.

The tax came into effect from July 1, 2017 through the implementation of One Hundred and First Amendment of the Constitution of India by the Indian Government. The tax replaced existing multiple Central and State Government taxes.

The tax rates, rules and regulations are governed by the GST Council which consists of the finance minister of central and all the states. GST is meant to replace a slew of indirect taxes with a unified tax and is therefore expected to reshape the country's 2.4 trillion dollar economy. GST tax rates vary from 0% - 28% depending on the type of service or Nature of Goods Your business is selling. The GST is paid by consumers, but it is remitted to the government by businesses selling goods and services. In effect, GST provides revenue for the government.

| Additional Read : | What is GST? |

|---|---|

| How to Login to Government GST Portal | |

| All about Government GST portal - www.gst.gov.in |

Online GST registration

GST (Goods and Services Tax) is essentially an Indirect tax which has been implemented to replace numerous taxes in India. Onlne GST registration was passed in the Parliament on 29th March 2017 yet it became effective on 1st July 2017 in India. As per the changes in the 32nd council meeting, the threshold limit for GST registration is 40 lakhs for the supplier of goods and 20 lakhs for the supplier of services. Along with that, the North-Eastern States have an option to choose between 20 lakhs and 40 lakhs. Once you have registered under this regime, you will receive a unique GSTIN (Goods and Service Tax Identification Number). There are various advantages of GST registration. You can also avail input tax credit and collect GST from recipients of goods and services.

Online GST registration can be easily done by visiting Online GST portal. It is easy to fill the form on GST online portal yet at the same time you require the expert's to fill the form with accurate information and submit the documents accordingly. Few of the terms while drafting for GST registration cannot be understood by many of the taxpayers. Therefore at the initial stage GST registration should be done with the help of experts and here at Legaldocs, you will be able to get done with your GST registration with a simple and quick process.

Additional Read : Online GST Registration Guideline

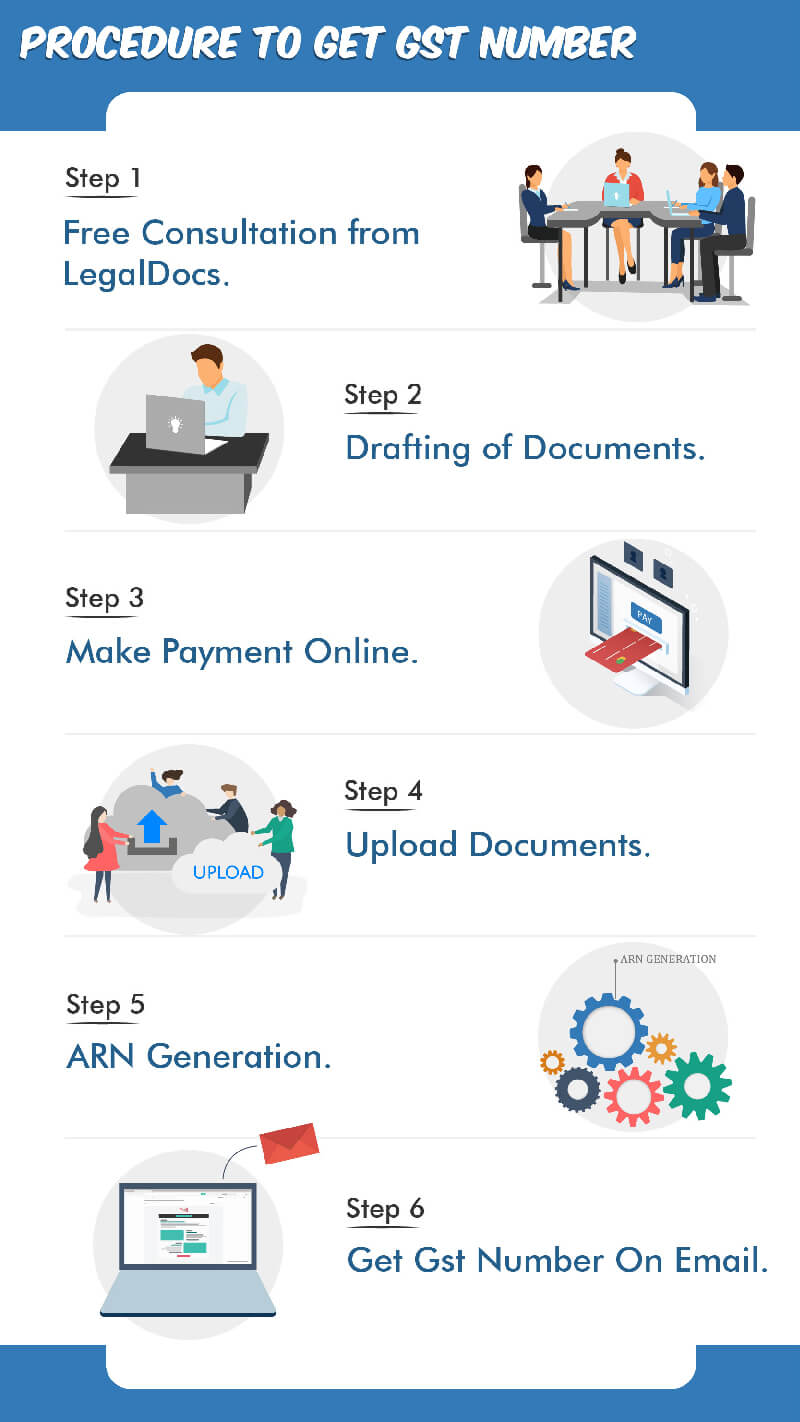

How to Register for GST

Timeline

Drafting, Payment and Document Upload

Our Team will consult you and help you with the drafting and Documents

Action Required by you

You need to fill up the simple form by logging in on LegalDocs website, make the payment after drafting. Upon Sucessful payment Document Upload section will be visible to the customer.

Action By Legaldocs

Legaldocs will Provide you free of cost consultation on eligibility, Documentation and Drafting

Application Submission

Application will be submitted to GST Department with necessary details and documents. In this step TRN and ARN are generated.

Action Required by you.

You need to share OTP which you receive on your phone and Email ID.

Action By LegalDocs

We'll work diligently on your application and submit it to GST Department.

Application Scrutiny

Application will be checked by GST authority in terms of proper documents and details.

Action Required by you

Just sit Back and Relax

Action By Legaldocs

We'll Follow up on the Application and Resolve queries Raised by GST Department

Approval

Congratulations, your GST Registration is sucessful.

Action Required by you

You'll Receive a Mail From GST Department having Login ID and password. you need to Logi to the Portal and Download the GST Certificate

Action By Legaldocs

LegalDocs Will share a Link for your Review and Suggestion. Choose your filing packages as per your monthly invoices and we'll do the filing for you.

GST Calculator Online

GST was introduced in the year 2017 on 1st July, for the purpose to reduce the multiple taxes and build up a uniform tax in India. GST is segregated in four different types such as ;

1. IGST (Integrated Goods and Services Tax)

2. UTGST (Union Territory Goods and Services Tax)

3. CGST (Central Goods and Services Tax)

4. SGST (State Goods and Services tax).

GST registration is necessary for every taxpayer who falls under GST criteria. There are many (at least more than 5) GST slabs in India, and if you are trading/working in multiple GST Slab goods, you have to calculate values with/without GST. GST Calculator Online helps you to get either gross or net profit on GST rates. The GST calculator online spares time and reduces the mistake which can be done by humans while calculating the expense on Goods and Services.

Additional Read : How to Calculate GST online?

List of Documents Required for GST Registration

| Proprietorship | Private Limited | Partnership/ LLP |

|---|---|---|

| PAN Card of Owner | PAN Card of Company | PAN Card of Partnership |

| Aadhaar Card Of Proprietor | Aadhaar of All Directors | Aadhaar of Partners |

| Bank Details | Bank Details | Bank Details |

| Address Proof | Address Proof | Address Proof |

| MOA, AOA and Incorporation | Partnership Deed/ LLP Certificate |

Additional Read : GST Compliance Checklist

Current Account Opening

A current account is a type of deposit account that helps the professionals and businessmen to run their business. Businessmen can avail various benefits by Online Current Account such as:

- Unlimited transactions

- Customized features

- Online banking services

Online current account reduces the hassle and provides the benefit to complete the banking process anytime and anywhere.

Are you Ready to Grow your Business?

- Zero Balance Current Account

- In just 5 mins

- Free Current Account Powered by ICICI Bank

Benefits of GST Registration

- You can legally collect taxes from your customers and pass on the Tax Benefits to suppliers.

- Business Becomes 100% tax Compliant

- You can Claim Input Tax Credit which you have paid on your purchases and improve profits.

- GST certificate can be used as one of the documents while opening current account or Business Account.

- You can easily apply for various states and Central Government tenders if you have GSTN.

- Expand your business through various channels like Online, Import-Exports

- To start payment gateways and use mobile wallets GST number is used.

What are Different Types of GST Registration?

For the filing of GST, transactions need to be classified depending on the type of customer to whom the sale is done. Following are the two different types of GST registration:

A. Registration Under Composition Scheme:

The Composition Scheme is for the small taxpayers in order to ease the tax compliance for them. This scheme allows eligible taxpayers to pay a percentage of their yearly revenue as a tax. Like small retailers, eateries and trading businesses. This will relieve the taxpayers/ businesses from collecting taxes from their customers directly and adds benefits as mentioned below:

- File Single Quarterly return, not multiple monthly returns.

- Pay Lower Tax which gives competitive advantage

- Books of Accounts and Records are easy to maintain under GST norms.

In short, this is a customer who has a business which is registered under the composition scheme of GST and has a GSTIN.

Following is the eligibility criteria to register under GST Composition Scheme :

- Must be a Registered Taxpayer

- Annual Turnover should be less than Rs 1 Crore

- Manufacturers of Goods, Dealers, and Restaurants (Not Serving Alcohol) can opt for this scheme.

B. Registration As a Casual Taxable Person:

Casual Taxable Person is a person who supplies taxable goods or services occasionally like a event management company which has various events in different states needs to register as a Casual Taxable Person for that particular taxable state before supplying or offering any goods or services.

Suppose Mr. 'A' has a business of consulting and who provide services in different states, then he needs to register as a Casual Taxable Person so that his business is compliant with the tax norms of that particular state.

Package Includes

Package Includes

| GST Certificate | GST invoice Template |

| GST Offline Invoice Software | GST HSN Codes and Tax Rates |

Who Needs GST Registration Number?

- Businesses having annual turnover morethan Rs 20 Lakhs Per Annum (Rs 10 Lakh for North Eastern States)

- If business is dealing in more than one state

- If your business has previous registration under VAT, Excise Laws, Service Tax Laws

- Selling your goods or services online (like selling on Amazon and Flipkart)

- If you are providing services and goods outside India.

| Additional Read : | How to Download GST Certificate? |

|---|---|

| How to Pay GST Online? |

Penalties Involved under GST Act

- Not having GST Registration : 100% tax Due or Rs10,000. Whichever is higher

- Not giving GST invoice : 100% tax due or Rs10,000. Whichever is higher

- Incorrect Invoicing : Rs 25,000

- Not filing GST Tax Returns : For Nil Return its Rs 20 Per Day, Regular Returns Rs 50 Per Day.

- Choosing Composition Scheme even if not eligible : 100% tax due or Rs10,000. Whichever is higher

| Additional Read : | Penalty for Late GST return Filing |

|---|---|

| Thresholds and Eligibility Criteria under GST |

GST Registration FAQs

How to register for GST?

1. Login to LegalDocs website.

2. Draft the documents.

3. Make the Online Payment.

4. Upload the required documents.

5. Generate ARN.

6. You will receive the GST number on your Email id.

How to apply for GST number?

1. Contact details.

2. Email address.

3. PAN (Permanent Account Number).

4. Draft all the documents.

5. Make online payment.

6. Upload the documents.

7. Generate ARN.

How much does a GST registration cost?

What is GST registration?

Who can register for GST?

1. Individuals registered under the Pre-GST law (i.e., Excise, VAT, Service Tax etc.)

2. Taxable person who supplies goods and the annual turnover of his business is above 40 lakhs and the one who supplies services with annual turnover of rupees 20 lakhs.

3. Casual taxable person / Non-Resident taxable person.

4. Agents of a supplier & Input service distributor.

5. Those paying tax under the reverse charge mechanism.

6. Person who supplies via e-commerce aggregator.

7. Every e-commerce aggregator.

How long does it take to get GST number?

What is GST (Goods & Service Tax)?

What is the concept of a destination-based tax on consumption?

Which of the existing taxes are proposed to be subsumed under GST?

a. Central Excise duty

b. Duties of Excise (Medicinal and Toilet Preparations)

c. Additional Duties of Excise (Goods of Special Importance)

d. Additional Duties of Excise (Textiles and Textile Products)

e. Additional Duties of Customs (commonly known as CVD)

f. Special Additional Duty of Customs (SAD)

g. Service Tax

h. Central Surcharges and Cesses so far as they relate to supply of goods and services.

B) State taxes that would be subsumed under the GST are:

a. State VAT

b. Central Sales Tax

c. Luxury Tax

d. Entry Tax (all forms)

e. Entertainment and Amusement Tax (except when levied by the local bodies)

f. Taxes on advertisements

g. Purchase Tax

h. Taxes on lotteries, betting and gambling

i. State Surcharges and Cesses so far as they relate to supply of goods and services

What is the status of Tobacco products after GST?

What type of GST is proposed?

Which authority will levy and administer GST?

What is IGST?

Who will decide rates for levy of GST?

How will imports be taxed under GST?

How will exports be treated under GST?

When did GST come into effect?

Will B2B transactions be subjected to GST?

What is an Input Tax Credit?

How can Input Tax Credits be applied?

CGST input tax credits can only be used to pay CGST and IGST

SGST input tax credits can only be used to pay SGST and IGST

IGST input tax credits can be used to pay CGST, SGST, and IGST

How and when should the returns be filed?

Can we claim GST interest refund after two years of payment?

How does GST apply to business?

Is PAN required to apply for GST?

Is there any specific time period for GST registration?

Who is a Casual Taxable Person?

Who are exempted from GST registration?

Any specialized agency of UNO (United Nations Organisation) or any multilateral financial institution and organization notified under the United Nations Act, 1947 Consulate or Embassy of foreign countries

Any other person notified by the Board/Commissioner

The Central Government or State Government may be based on the recommendation of the GST Council, notify exemption from registration to specific persons.

Is there any provision in GST for the tax treatment of goods returned by the recipient?

Are all goods and services taxable under GST?

What is meant by Reverse Charge?

What is the registration process for GST in India?

Application Drafting

ARN Number

Registered GST Number

Knowledge Center

Knowledge Center