What is current account?

Basically, a bank has two types of Account, One is a Current Account and another one is a Savings Account. Current Account is maintained by the businesses who have a large number of Transactions regularly. It is an Account where there is no limit of Transaction to be done in a done.

Introduction

Let us understand What is a Current Account? Current Accounts are well known among the business sectors such as Public companies and enterprises, firms, etc. Along with business account, the current account is also known as a Demand deposit account.

Current Account can be opened in every Indian bank. Once a business owner holds a Current Account, he is liable for various customized options provided by the bank.

With compared to a savings account, current account should hold a larger amount of balance, where the business person should maintain a minimum balance in his account.

The major purpose of a Current Account is for the convenience of the business and not to invest the money as savings.

Features of Current Account

- Current Accounts are opened for running a business, therefore they are also known as Business Accounts.

- It is necessary to maintain higher amount of balance in the account as compared to Savings Account

- For the Current account holder, there are no limitation for transactions to be done within a day.

- Its helps to do frequent transactions, transfer funds, receive checks etc.

- In case the Current account holder does not hold minimum balance, then he is liable to pay penalty on the same.

- There should be no multiple current accounts for a single business.

- There are few banks who offer Interest rates on Current Account.

- The Current Account can be opened by an individual, Public and private sectors, companies, trusts etc.

- There is no restriction for the number of amount deposited.

Benefits of Current Account

- Current Account allows for prompt business transactions.

- There is no limit on Withdrawal and amount deposited.

- Bank provides Overdraft facility to the Current account holder.

- Later the companies are benefited with various advantages such as free inward remittances, deposit and withdrawals from anywhere, multi-location transfer etc.

- It is also possible to access the account with Internet and Mobile banking, which will be helpful to the account holder and can access the account with ease.

- The business man can transfer his funds in electronic way.

- Few banks avail interest on the deposited amount.

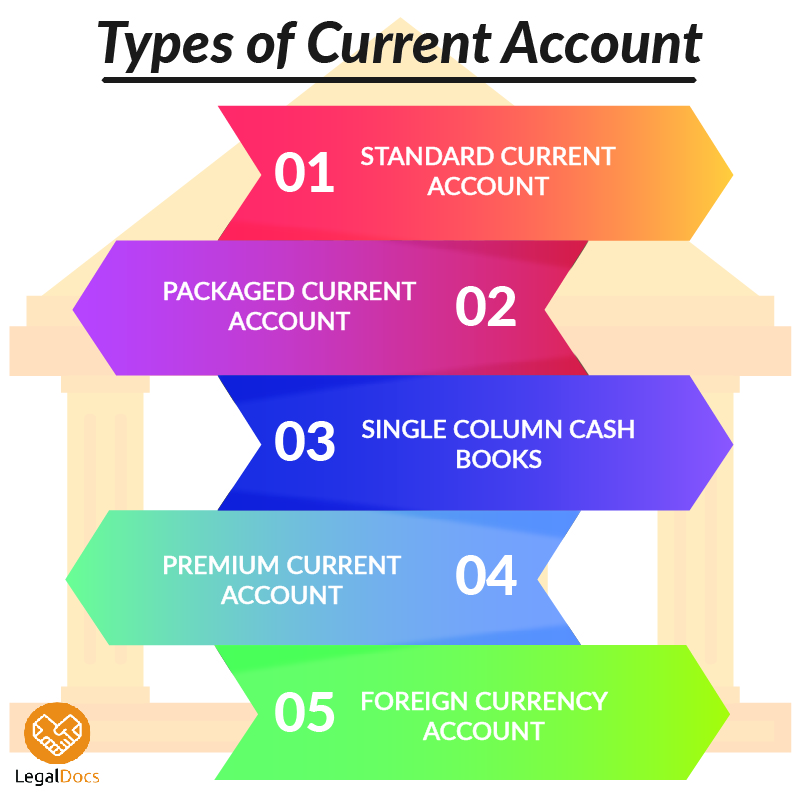

Current Account Types

- Standard Current Accounts

Standard Current Account comes for monthly average balance. It is a non-interest bearing deposit account. - Packaged Current Accounts

A packaged account provides lots of facilities in one such as, Medical support, Travel insurance, etc. - Single Column cash Books

It is a simple cash account which allows daily transaction but does not provide the facility of Overdraft. - Premium Current Accounts

The name itself specifies its meaning, that the Premium account provides various benefits and offers to the account holders. This type of account is useful for the people who has a large number of daily transactions. - Foreign Currency Accounts

Frequent transaction of the business holders which is carried out in foreign countries has to get this type of license

Knowledge Center

Knowledge Center