Why Choose LegalDocs?

- Lowest Price Guarantee

- No Office Visit, No Hidden Cost

- Serviced 50000+ Customers

GST calculator Online in India

GST calculator Online will help you to let you know the accurate amount of your product and services after applying GST on it. So the calculation can be done easily while filing a return but, the taxpayer should be aware of the required charges while filing. For this, the GST calculator online will be useful.

GST payment calculator helps you to find out the gross or net price of the product based on GST rates. It does not consume time and no error can be caused, comparing the human calculation. You can calculate GST on the free Online GST calculator in India.

How to calculate GST

It is very simple to calculate GST with the help of GST calculator online.

Following are the

steps of how to calculate GST online :

1. Mention the Net Price of the Goods and Services.

2. Along with this mention the GST rate slab (0%, 5%, 12%, 18%, 28%) accordingly.

3. Submit after entering the details and get to know the total or gross price of the product.

Additional Read : How to Calculate GST Online?

GST Rates: How to Calculate GST Rate In Different Cases

Case 1: GST Calculation for Wholesalers and Retailers

If a Wholesaler, Retailer, and Trader is Buying a Product or Service ABC at 100 Rs. His profit margin on this product and service is 10%. The GST Tax Slab rate is 12% for this particular Product. So the GST Calculation working will be as follows :

GST calculation wholesalers and retailers :

| Sr. No | Particulars | Cost Working |

| A | Purchase Price ( Gross Price) | 100 |

| B | GST Tax Rate | 12% |

| C | Profit Margin @10% | 10 |

| D | Tax Amount (A+C)*B | 13.2 |

| E | Selling Price Including Tax (A+C+D) | 123.2 |

When you file GST you need to file the tax amount of Rs13.2, however, you will get input credit

of the extra tax you paid i.e. on Rs100. So whoever the intermediaries which are involved from

Manufacturing till End Consumer will pay taxes only on profit (consumption). Rest of the tax

amount paid will be credited( input credit) to the Taxpayer. (Reverse Charge is not Applicable

for the Food Serving businesses/ Restaurants)

Net GST Amount is Bifurcated As

A. Transaction in the same state :

50% SGST = STATE GST

50% CGST = CENTRAL GST

Out of the 100% tax amount, 50% will be deposited to the State government and 50% will be deposited to the central Government.

B. Transaction within Different State :

100% IGST = Complete 100% tax which is collected will be deposited to the Central Government

C .Transaction within Union Territory

100% UTGST or UGST = Union Territory GST Complete 100% tax which is collected will be deposited to the Respective union territory.

Case 2: GST Calculation for Manufacturers

In the case of the Manufacturing business, the manufacturer purchases raw material and

processes the raw material and makes the finished good. So let's consider one case

Raw material Costs = Rs70

Processing cost = 30

Profit Margin = 10%

So the Invoice Rate including GST will work out in the following Fashion :

GST calculation for manufacturers :

| Sr. No | Particulars | Cost Working |

| A | Cost of Manufacturing(Raw Materials+Processing Cost | 100 |

| B | Profit Margin @10% | 10 |

| C | GST Rate @28% (A+B)*28% | 30.8 |

| D | Total Amount After Tax | 140.8 |

Case 3: GST Calculation for Buyer

In case of Buyer, the GST will be applicable to the selling price ( cost of goods sold) and the

GST tax slab rate whichever is applicable :

Suppose Person X is buying a good XXX at price 1000 rs and the GST rate applicable to the good

is 12% then the cost working will be as follows :

Buyer :

| Sr. No | Particulars | Cost Working |

| A | Buying Price | 1000 |

| B | GST Rate @12 % | 120 |

| C | Purchase Price Inclusive of Taxes | 1120 |

GST Calculation Formula

GST calculation formula is liable for the Manufacturers, Business Owners, Wholesalers etc, the GST calculation method can be completed by using the formula mentioned below:

Simple GST Calculation The formula which can be used while adding GST is given below.- 1. Amount of GST Applicable = ( Original Cost of the Product x % GST rate) / 100

- 2. Net Price = Cost of Good + GST Applicable Amount.

The formula which can be used while removing GST is given below. (reverse GST calculation formula)

- 1. Amount of GST = Original Cost - [Original Cost x {100/(100+GST%)}]

- 2. Net Price = Original Cost - GST Amount

Reverse GST calculator

Reverse charge will be applicable in the situation when a vendor who has not applied for GST, supplies goods to the one who is registered under GST, in this case, GST reverse charge will be applied.Here the receiver will pay the fees directly to the government instead of the supplier who is not registered under GST.The dealer who is registered under GST and have to pay reverse charge should make his own invoice for the purchased goods and services.This GST rate calculator can also be used as a Reverse GST calculator.

Additional Read : Reverse GST Calculator

GST Calculator In India

Details of all the aspects such as reverse charge, interstate sales, exempted supply etc required for a taxpayer can be calculated on GST calculator online India.

Current Account Opening

A current account is a type of deposit account that helps the professionals and businessmen to run their business. Businessmen can avail various benefits by Online Current Account such as:

- Unlimited transactions

- Customized features

- Online banking services

Online current account reduces the hassle and provides the benefit to complete the banking process anytime and anywhere.

Are you Ready to Grow your Business?

- Zero Balance Current Account

- In just 5 mins

- Free Current Account Powered by ICICI Bank

FAQs

How to Calculate GST Online?

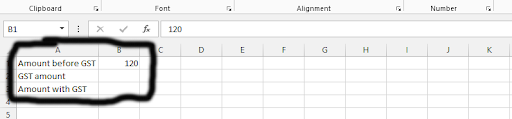

How to Calculate GST in Excel in India?

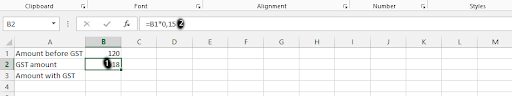

You have to click on the column beside the GST amount and decide how many percentages you would like the GST to be. We are going with 25%, and therefore writing = B1*0.25

You have to click on the column beside the GST amount and decide how many percentages you would like the GST to be. We are going with 25%, and therefore writing = B1*0.25

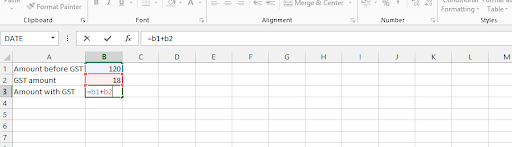

Click on the column beside the amount with GST, and type in =B1+B2 to get the answer.

Click on the column beside the amount with GST, and type in =B1+B2 to get the answer.  Knowledge Center

Knowledge Center