Why Choose LegalDocs

- Lowest Price Guarantee

- No Office Visit, No Hidden Cost

- Serviced 50000+ Customers

What is Letter of Undertaking (LUT) in GST?

Letter of Undertaking/LUT in GSTis prescribed to be furnished in the form GST RFD 11 under rule 96 A, whereby the exporter declares that he or she will fulfill all the requirements that are prescribed under GST while exporting without making IGST payment.

Who Needs to File Letter of Undertaking (LUT) in GST(Form GST RFD-11)?

GST LUT is to be submitted by all GST registered goods and service exporters. The exporters who have been prosecuted for any offense and the tax evasions exceeding Rs 250 lakhs under CGST Act or the Integrated Goods and Service Act, 2017 or any existing laws are not eligible to file the GST LUT. In such cases, they would have to furnish an Export bond.

Here the motive of the government was to expand the export base by providing reliefs on exports. GST experts from IndiaFilings can help you with GST LUT filing or Export bond Filing.

Under CGST Rules,2017, any registered person can furnish an Export bond or LUT in GST RFD 11 without paying the integrated tax. They can apply for LUT if:

- They intend to supply goods or services to India or overseas or SEZs

- Are registered under GST

- They wish to supply goods without paying the integrated tax

Documents Required for Filing LUT in GST

Following are the documents required for filing Letter of Undertaking(LUT) in GST.

- LUT cover letter - request for acceptance - duly signed by an authorized person

- Copy of GST registration

- PAN card of the entity

- KYC of the authorized person/signatory

- GST RFD11 form

- Copy of the IEC code

- Cancelled Cheque

- Authorized letter

How to File Letter of Undertaking (LUT) in GST?

Follow the simple 3 Step procedure to File Letter of Undertaking(LUT) Online

- Avail GST filing/ monthly LUT filing package from LegalDocs

- Our team will connect with you on a monthly basis for details.

- LegalDocs expert team will file LUT and will share the acknowledgement.

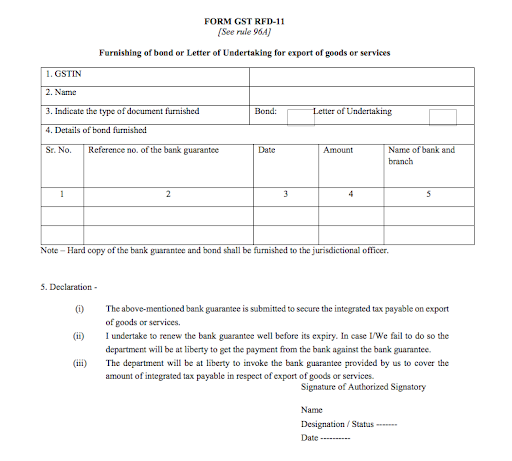

Form RFD 11 Format

The Form RFD-11 is filed in the format below:

Registered Name :

Business Address :

GSTIN (GST number) :

Date of furnishing :

Signature, date, and place :

Details of witnesses (Name, address, and occupation) :

Please refer to the attached form :

Letter of Undertaking (LUT) in GST Format

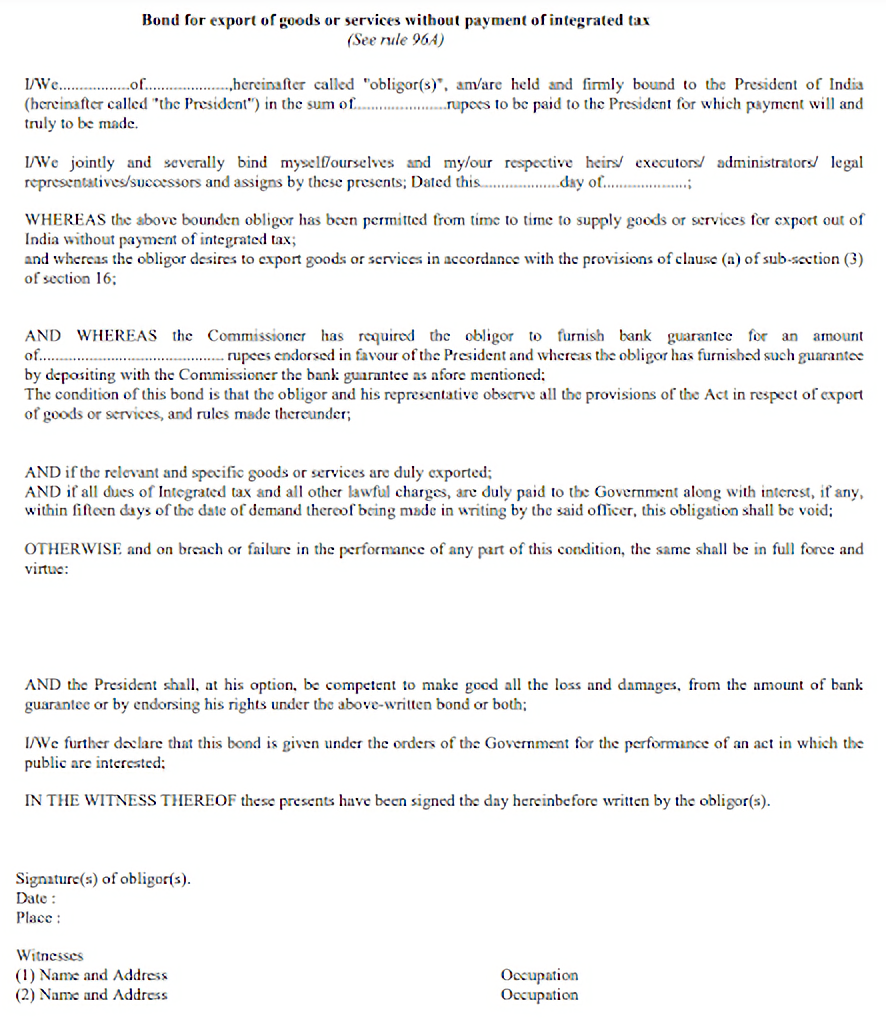

Export Bond for GST

Entities that are not eligible to submit a Letter of Undertaking based on the conditions mentioned will have to furnish an export bond and a bank guarantee. The applicant needs to cover the amount of tax involved in the export based on estimated tax liability self-assessment.

Export bond should be furnished on non-judicial stamp paper of the value as applicable in the State in which the bond is being furnished.

Also, exporters can furnish a running bond, so that export bond needs not to be executed for each export transaction. However, if the outstanding tax liability on exports exceeds the bond amount at any time, then the exporter must furnish a new bond to cover the additional liability.

A bank guarantee can be mandated along with an export bond. The value of the bank guarantee should usually not exceed 15% of the bond amount. However, based on the exporter's track record, the bank guarantee required to be submitted with the export bond can be waived off by the jurisdictional GST Commissioner.

Current Account Opening

A current account is a type of deposit account that helps the professionals and businessmen to run their business. Businessmen can avail various benefits by Online Current Account such as:

- Unlimited transactions

- Customized features

- Online banking services

Online current account reduces the hassle and provides the benefit to complete the banking process anytime and anywhere.

Are you Ready to Grow your Business?

- Zero Balance Current Account

- In just 5 mins

- Free Current Account Powered by ICICI Bank

LUT filing Under GST FAQs

What is LUT and why is it used?

When to apply/file an LUT and what was the scenario before GST?

What should be filed in the letter of Undertaking(LUT)?

Who Signs the LUT Application?

Is it mandatory to file GST LUT?

What if LUT is not filed on time?

How do I check my LUT status?

To view the submitted Letter of Undertaking (LUT) at the GST Portal, perform the following steps:

- 1. Access the GST Portal at www.gst.gov.in URL. ...

- 2. Login to the GST Portal with valid credentials.

- 3. Click the Services > User Services > View My Submitted LUTs command.

What documents are required for GST LUT Filing?

Following are the documents required for filing Letter of Undertaking(LUT) in GST.

- LUT cover letter - request for acceptance - duly signed by an authorized person

- Copy of GST registration

- PAN card of the entity

- KYC of the authorized person/signatory

- GST RFD11 form

- Copy of the IEC code

Knowledge Center

Knowledge Center