Which Banks Provide Automatic Loan Moratorium

Following a nudge from RBI, Banks and NBFCs have offered borrowers a 3-months moratorium on payment of loan installments starting March. If you take the moratorium, your credit score will not be affected. However, you will have to pay additional interest for three months (for deferring equated monthly installment (EMIs)) to your lender.

Different banks have announced their policies. Some banks make that moratorium

process default by there ends while some banks are asking their customers to opt-in for the moratorium process.

As per the survey we classify banks according to their moratorium processes.

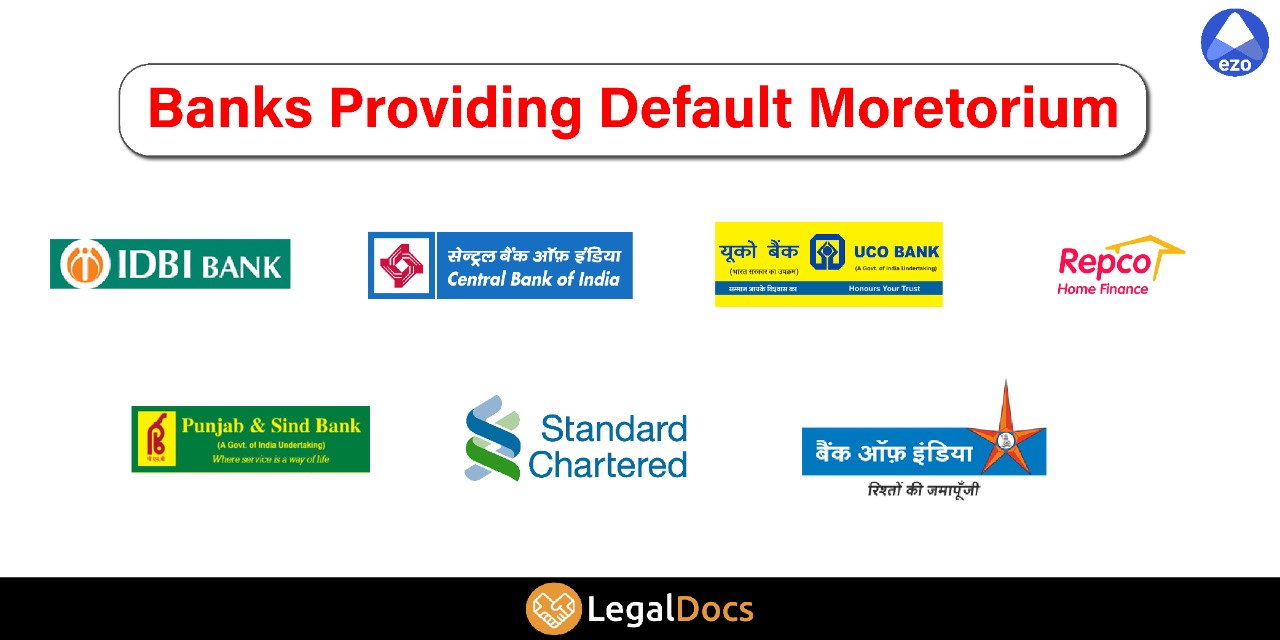

Banks Providing Default Moratorium :

As per the RBI announcement following banks are going to apply loan Moratorium default to their all borrowers :

IDBI Bank

Central Bank of India

UCO Bank

Repco Home Finance

Punjab & Sind Bank

Standard Chartered Bank

Bank of India

Banks asking Opt-In for Moratorium :

As per the RBI announcement following banks are going to apply loan Moratorium but on customer demand, their borrowers have chosen to opt-in and an opt-out option to continue.

State Bank of India

Canara Bank

ICICI Bank

IDFC FIRST Bank

Bank of Baroda

HDFC Bank

Kotak Mahindra Bank

Bajaj Finserv

PNB Housing

Indiabulls Housing

Axis Bank

Fullerton India

RBL Bank

HSBC Bank

Ezo suggests all Businesses people to Avail the EMI moratorium for three months and based on the cash flow situation at the end of this crisis, you can decide to pay earlier.

To know if the Moratorium Process is profitable or not, please Click Here

Knowledge Center

Knowledge Center

LEAVE A REPLY: