Eligibility for ICICI Bank Current Account

There are few business entities who are eligible to open a Current Account such as mentioned below:

- An individual

Any individual is liable to open a Current Account, unless and until he has all the required documents for opening a Current Account. - A partnership firm

A partnership firm is when two or more than two people come together to run a business, this type of business entities can be known as a Partnership firm. - A company

A company is a firm or an enterprise where any business takes place with the help of a group of people. A company is liable to open a Current Account. - Trusts

A trust is a company which is owned by, a bank, a partnership firm or a law firm. A trust can open a Current bank account while initiating the firm. - Sole Proprietors

A sole proprietor or sole trader is a sort of big business that is claimed and kept running by one individual. - HUF (Hindu Undivided Family)

HUF (Hindu Undivided Family) is defined under Hindu law and they can open a Current Account.

Features of ICICI Bank Current Account

There are few business entities who are eligible to open a Current Account such as mentioned below:

- Current accounts are opened to run a business

- Some banks provide interest on Current account and some banks cannot provide any interest in Current account.

- Compared to savings account Current Account holder has to maintain more balance.

- Various facilities such as Overdraft facility, Internet banking, mobile banking are provided to the Current Account holder.

- There are no limitations for Transactions and depositing amount in a day.

- Non-cash transactions as per the MAB (Monthly Average Balance)

- Any type of free transactions can be made up to 200.

Why to Choose Legaldocs for opening a Current Account?

If you are ready to open a current account, then you need to have the appropriate details and documents with you. Choose legaldocs as your wise opinion and apply for Current Account through Legaldocs.

Merits by opening a current account with Legaldocs are mentioned below:

- No need to make regular visits in bank for opening a Current Account.

- Get hassle free service

- You can avail the option of non - maintaining minimum balance not for 6 months but for ever.

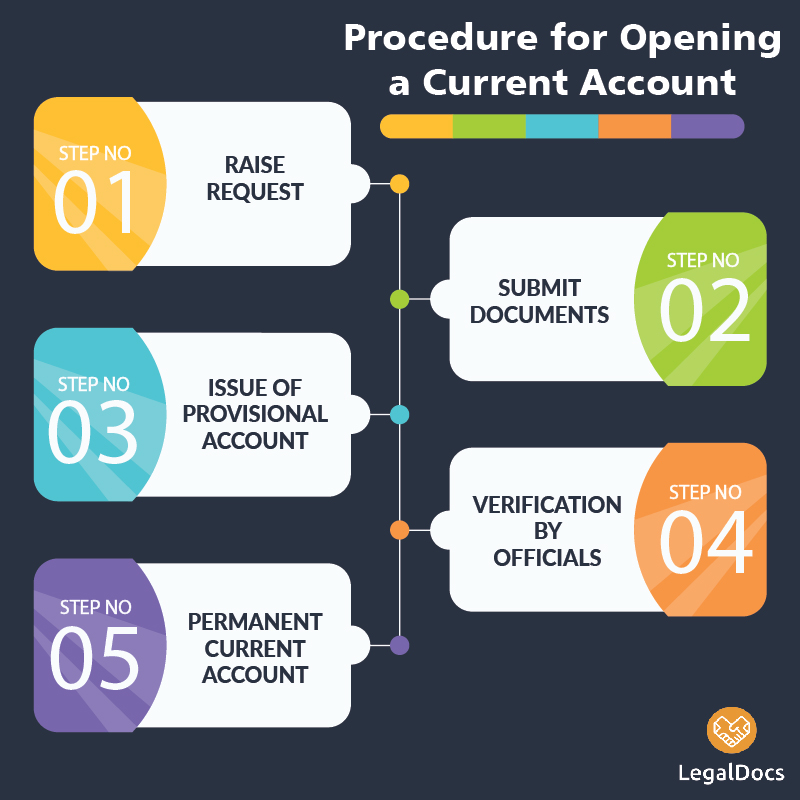

Procedure to Open Current Account Online

Raise a request

Log on to Legaldocs website and raise a request for Online Current Account opening.

Declare KYC details

You will have to declare KYC details of legal entity, like details of business owners, nature of business, location of business, government approvals like Shop Act license

Account number generated

After submission of all the documents a provisional account number will be provided

Officers visit for verification

ICICI officers will visit at your business place and verify all the documents

Opening a Current Account

After verification provisional current account will be converted into permanent current account.

Documents Required to open ICICI Bank Current Account

For opening a Current Account in ICICI bank you require few licenses, they are mentioned below:

Individual

- Proof of identity

- PAN card

- Voter ID card

- Passport

- Driving license

- Proof of address

- Aadhar Card

- Valid Passport

- Utility bill

- Property tax bill

- Recent Colour Photograph

- Account opening Cheque from existing Savings/Individual Current Account

- PAN/Form 49 A along with Form 60 if applied for PAN

Partnership firm

- Two passport size color photographs

- Partnership deed document

- Identity Proof: PAN Card of the entity

- Address proof of business location.

Sole Proprietorship or HUF (Hindu Undivided Family)

- Two passport size color photographs

- Identity Proof

- PAN card

- Voter ID card

- Passport

- Driving license

- Address Proof

- Aadhar Card

- Valid Passport

- Utility bill

- Property tax bill

- etc.

- Contact Details

- Landline or mobile number

- E-mail ID

Trusts

- Document of the entity

- Directors updated list

- Identity Proof

- PAN Card of the entity

- Address Proof

- Aadhar Card of the sole proprietor/ entity

- Valid Passport

Limited Liability Partnership

- Company registration certificate of LLP.

- Identity Proof

- PAN Card of the entity

- Address Proof

- Aadhar Card of the sole proprietor/ entity

- Valid Passport

- Two passport size color photographs.

ICICI Current Account Details

| ICICI Bank Current Account | ICICI Bank Current Account Minimum Balance |

Non Maintenance Charges |

| New Start-Up Current Account | NIL | N/A |

| Shubh Aarambh Current Account | NIL for the first six months, Rs. 25,000 thereafter |

Rs. 1,000 per month |

| Smart Business Account | Rs. 25,000 | Rs. 1,000 per month |

| Smart Business Account Gold | Rs. 1 Lakh | Rs. 3,000 per month |

| Roaming Current Account Standard | Rs. 10,000 | Rs. 750 |

| Roaming Current Account Classic | Rs. 25,000 | Rs. 1,000 |

| Roaming Current Account Premium | Rs. 50,000 | Rs. 1,500 |

| Roaming Current Account Gold | Rs. 1 Lakh | Rs. 2,000 |

| Roaming Current Account Gold Plus | Rs. 3 Lakh | Rs. 3,000 |

| Roaming Current Account Platinum | Rs. 5 Lakh | Rs. 2,500 if MAB more than 50 percent and Rs. 5,000 if MAB is less than 50 percent |

| Roaming Current Account Elite | Rs. 10 Lakh | Rs. 5,000 if MAB is more than 50 percent and Rs. 10,000 if MAB less than 50 percent |

| Made2Order Account | Rs. 3 Lakh | N/A |

| Trade Current Accounts | For Trade Basic Rs. 50,000 For Trade Gold Rs. 1 Lakh For Trade Platinum Rs. 5 Lakh |

For Trade Basic - Rs. 1,500 per month For Trade Gold - Rs. 2,000 per month For Trade Platinum - Rs. 2,500 per month if MAB/MTP is more than 50 percent and Rs. 5,000 per month if MAB/MTP is less than 50 percent |

Types of Current Account in ICICI Bank

ICICI bank provides different types of Current Account to different types of Entities, they are mentioned below:

New Startup Current Account

- In the New Startup current account, the minimum required balance is NIL.

- ICICI provides customized payments and collection solution to the business model.

- For base withdrawal Cash withdrawal limit is unlimited and for non-base withdrawal, it is RS 50000.

- For Import and Export, preferential charges are provided by ICICI bank.

ShubhAarambh Current Account

- Non-cash transaction for MAB (Monthly Average Balance)

- There is no restriction or limitation of maintaining a minimum balance for 6 months.

- For 6 months you can utilize freedom for not maintaining a minimum balance, later on, the amount to be maintained is of Rs 25000.

- Penalty for not maintaining minimum balance is Rs 1000.

- ShubhAarambh account can be opened by the proprietors only.

- The validity for opening an account should not more than 6 months from the date of Incorporation.

- PAN/Form 49 A along with Form 60 if applied for PAN

- The proprietor should not have any existing current account with ICICI bank.

Smart Business Account

- Minimum required a balance to be maintained is Rs 100000.

- 300 free transaction of any type.

- For not maintaining the minimum balance, charges will be Rs 3000.

- For base withdrawal Cash withdrawal limit is unlimited and for non-base withdrawal, it is RS 50000.

- Auto loan and locker facilities are available.

Roaming Current Account Standard

- 25 checks free per month.

- Minimum required balance is Rs 10000

- Penalty for not maintaining minimum balance is Rs 750.

- For base withdrawal Cash withdrawal limit is unlimited and for non-base withdrawal, it is RS 50000.

Roaming Current Account Classic

- 50 checks free per month.

- Minimum required balance is Rs 25000

- Penalty for not maintaining minimum balance is Rs 1000.

- For base withdrawal Cash withdrawal limit is unlimited and for non-base withdrawal, it is RS 50000.

Roaming Current Account Premium

- 100 checks free per month.

- Minimum required balance is Rs 50000

- Penalty for not maintaining minimum balance is Rs 1500..

- For base withdrawal Cash withdrawal limit is unlimited and for non-base withdrawal, it is RS 50000.

Roaming Current Account Gold

- Minimum required balance is Rs 100000

- Penalty for not maintaining minimum balance is Rs 2000.

- For base withdrawal Cash withdrawal limit is unlimited and for non-base withdrawal, it is RS 50000.

Roaming Current Account Gold Plus

- 600 checks free per month.

- Minimum required balance is Rs 300000

- Penalty for not maintaining minimum balance is Rs 3000.

- For base withdrawal Cash withdrawal limit is unlimited and for non-base withdrawal, it is RS 50000.

Roaming Current Account Platinum

- Business banking debit card for free

- Minimum required balance is Rs 500000

- Penalty for not maintaining minimum balance is Rs. 2500 if MAB more than 50 percent and Rs. 5000 if MAB is less than 50 percent.

- For base withdrawal Cash withdrawal limit is unlimited and for non-base withdrawal, it is RS 50000.

Roaming Current Account Elite

- Business banking debit card for free

- Minimum required balance is Rs 500000

- Penalty for not maintaining minimum balance is Rs. 5000 if MAB more than 50 percent and Rs. 10000 if MAB is less than 50 percent.

- For base withdrawal Cash withdrawal limit is unlimited and for non-base withdrawal, it is RS 50000.

Made to Order Account

- For base withdrawal Cash withdrawal limit is unlimited and for non-base withdrawal, it is RS 50000

- Minimum required balance is Rs 300000

- Flexibility in deciding the MAB

- Flexibility in deciding the higher free Limits in services which are required frequently

- Flexibility in choosing free cheque leaves

Trade Current Accoun

- Digital Alerts

- Preferential pricing for Cash Management Solutions, Locker Charges, Auto Loan and Personal accidental Insurance at the time of account opening

- Dedicated Relationship Manager for every Trade Current account

- Minimum balance requirement is For Trade Basic Rs. 50,000 For Trade Gold Rs. 1 Lakh For Trade Platinum Rs. 5 Lakh

- Charges for non-maintenance of the minimum balance is For Trade Basic - Rs. 1,500 per month For Trade Gold - Rs. 2,000 per month For Trade Platinum - Rs. 2,500 per month if MAB/MTP is more than 50 percent and Rs. 5,000 per month if MAB/MTP is less than 50 percent

- For base withdrawal Cash withdrawal limit is unlimited and for non-base withdrawal, it is RS 50000

FAQs

What is the interest rate on ICICI banks Current Account?

The minimum amount for opening a Current Account in ICICI bank?

What is the procedure of opening a Current Account Online in ICICI bank?

Step 2 - You will have to declare KYC details of legal entity, like details of business owners, nature of business, location of business, government approvals like Shop Act license

Step 3 - After submission of all the documents a provisional account number will be provided

Step 4 - ICICI officers will visit at your business place and verify all the documents

Step 5 - After verification provisional current account will be converted into permanent current account.

Knowledge Center

Knowledge Center