Points to remember before any Property Dealing

"Precaution is better than cure". This holds true and strong when we talk about property dealing. Since property dealing involves a huge amount of resources in terms of money, it is most appropriate to take decisions regarding property deals with precaution. Although there are several laws governing the safe property dealing, however, self-help is the key to safe property dealing. There are many people who confuse and equate real estate market with the stock market. They tend to buy a property in the hope of making a quick profit without really understanding their own personal needs. It must be noted that property transactions take time. For this purpose,

Here are a few key legal points to be remembered for any property dealing:

Approval and licenses: Select the property and check the paperwork. This includes all the documents ranging from commencement certificate for work, environmental clearances, and building plans. Some of the approval and license that need review are:

Release certificate: In case one is buying a property which was occupied by a prior bank loan, then one must require a release certificate from the bank.

Check Encumbrance Certificate: this ensures if the land being bought is free from all kinds of legal dues.

Verification of land use: City master plan will reveal if the land being dealt lies in which land use zone. One must get it verified from the office of the local body.

Approvals by local bodies: this includes approvals by the development corporations.

Property tax receipts: One must ensure the pending bills of the property. For instance, if the property being dealt with is being resold, previous property tax receipts from the seller must be checked.

Title of the land: one must ensure the status of the title of the land. It is important to ensure the owner of the land and who has development rights for the same. Various ways to ensure clear title to property are:

The documents of title must ensure the ownership of the property. Study the documents carefully. In case, one is buying a plot, see the title deed to know if the builder has full right to it.

Taking inspection of the original title deed.

Search for land records from the Sub-registrar office.

Search the records of the society where the property is. A mere no-objection certificate from the panchayat or the local body does not necessarily mean approval by the authority.

One can also issue a public notice in newspapers requesting for claims in respect to the property.

List of banks financing the project: With the emerging real estate market, a lot of developers and builders have come up with an unsold inventory of property. Many builders opt for loans for financing their project. On the contrary, there are many builders who do not take bank loans at all. It is thus important to check the funding of the project in which one is deciding to deal a property. If one opts for a loan, choose the one with lowest rates.

Inspect sanctioned plans: It is important to inspect the sanctioned plans for the construction projects from the associated authority. In case the building is still under construction, one must check the commencement certificate. A completion certificate is granted to the buildings on their completion.

Power of Attorney: Many times, a property is sold or purchased through a person holding Power of Attorney. This must be closely scrutinized and must be executed to a close relative only.

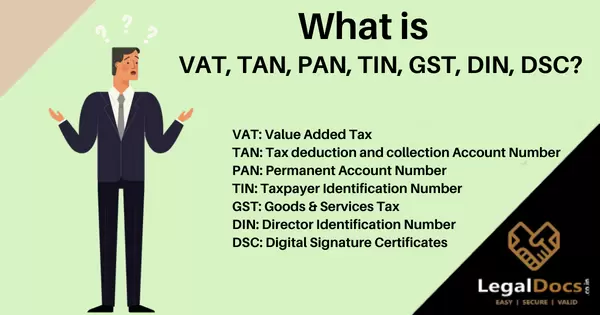

Calculation of the total cost involved: there are many factors that must be included while calculating the cost of the property. Besides the basic cost of land, there is also internal and external development fees, location charges, parking charges, and goods and service tax. Many people choose to finance their properties from financial institutions. The cost of acquiring finance must be included in the total cost.

Verification of the builder: Verify the builder to ensure that the property being dealt is not under litigation. An extensive verification of the builder and developer is key to successful property dealing. This can be done by looking at the current projects of the builder or the developer. One may also get a review about the builder or the developer through the projects that it has completed. One can check this by the quality delivered in its previous projects. Besides, there are various plans provided by them to choose from. One must be careful in choosing the development plan provided by the broker, developer or builder as any late payment or default by the builder in schemes will impact their credit history.

Check the supporting infrastructure: Any big infrastructural development coming up in the future near the property to be dealt with can boost the reason to buy the property tremendously. This may a metro connectivity coming up. For residential properties, one must check the availability of electricity and water in the area. The security of the area is also to be considered. One must ensure that the residential property is away from any polluting source. Here proximity to amenities adds value to the property.

Check the site: It is always important to check the site physically. Virtual appearance may differ from reality. One may even opt to interact with neighbors to know more about the area and any legal disputes related to the property.

Register your plot: Once the selection of the property is done, one must register the property with the concerned authority. Registration of a sales deed is important to become the lawful owner of the property. This gives the owner the right of the property right from the date of execution of the deed.

Are you looking for Rent Agreement Registration Service in India?

Legaldocs will guide you in getting all necessary Documents and Registration required to get Rent Agreement Registration in India, Please click on the following link to connect with our consultants.

Knowledge Center

Knowledge Center

LEAVE A REPLY: