Benefits of Udyog Aadhaar

What is Udyog Aadhar?

Introduction of Udyog Aadhar was to simplify the process for the business owners to register their business under Micro Small Medium Enterprise or MSME.

Earlier the procedure for MSME Registration was hectic and time-consuming but with the introduction of Udyog Aadhaar, things have changed to a certain extent.

Udyog Aadhar is a government registration provided with a recognition certificate and a unique number in order to certify micro, small and medium enterprises.

Before initiating UAM system (Udyog Aadhar Memorandum), there used to be a former system of EM-I/II (Entrepreneur Memorandum). Entrepreneur Memorandum –I (EM-I) and Entrepreneur Memorandum –II (EM-II) forms which in turn consisted of almost 11 different forms along with the necessary attested certificates.

Under EM-I/II system the registration was 21,96,902 (2007 - 15) and later from the year 2015 till today it has reached to 68,06,714.

Not only this, but there are various other benefits of Udyog Aadhar for Micro, Small and Medium Enterprises in India. Here in this article, we will understand the benefits of Udyog Aadhar Registration.

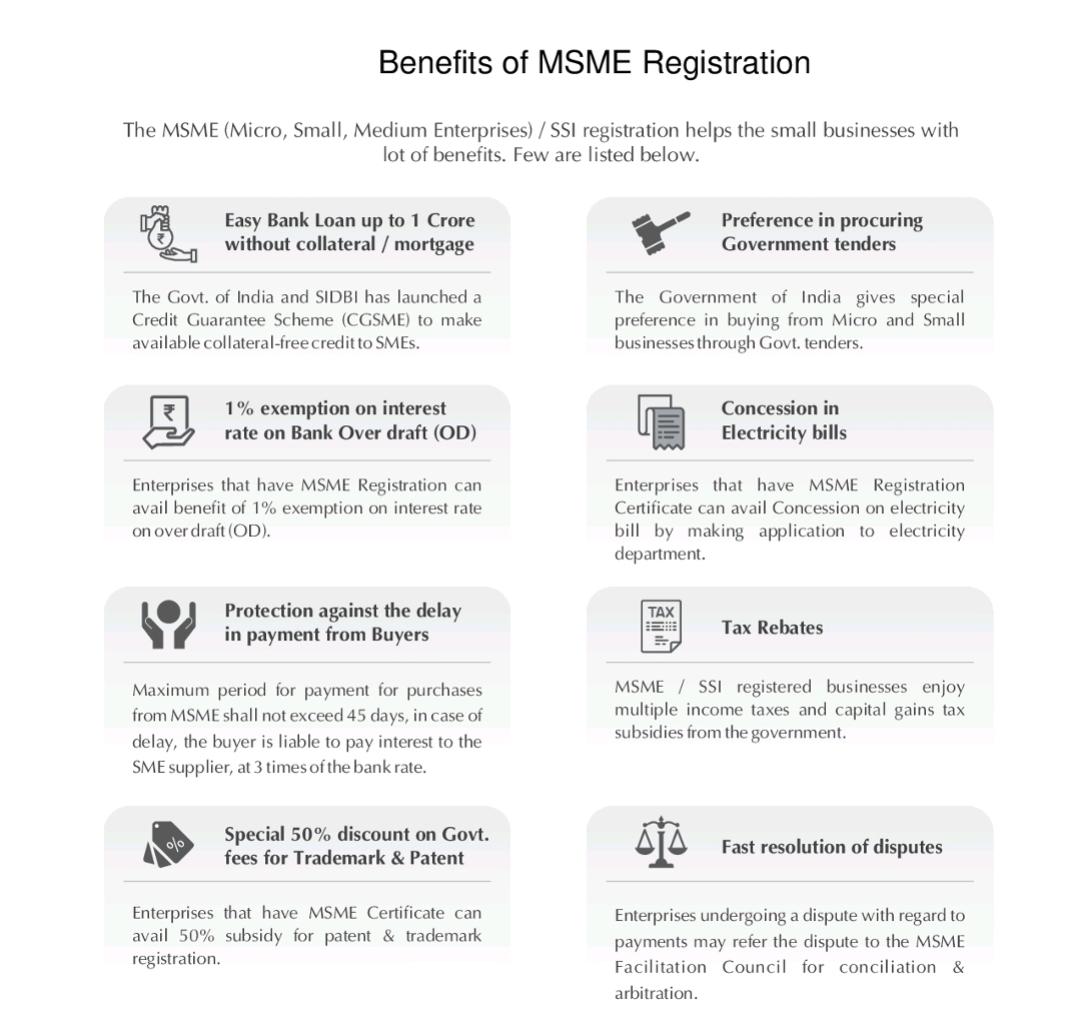

Benefits of Udyog Aadhar

Do you want to know benefits of MSME/Udyog Aadhar Registration? If yes, then you should check out stated below benefits.

- Easy Bank Loan upto 1 Cr without Collateral/ Mortgage

- Special Preference in Procuring Government Tenders

- 1 percent Exemption on interest rate on Bank Over Draft (OD)

- Concession in Electricity Bills

- Protection against the delay in payment from Buyers

- Tax Rebates

- Special 50 percent discount on Government fees for Trademark and Patent

- Fast Resolution of Disputes

Protection

The business owner will get protection against delay in Payment.

Collateral free loans

You can also avail collateral free loans from the bank.

Octroi benefits

The business owner can avail octroi benefits.

Claim charges

Claim stamp duty and registration charges.

Rate of interest

Rate of interest from the banks can be reduced.

Concession in electricity

The business owner who opts for Udyog Aadhar can get a concession on Electricity bills.

Interest on OD

Exemption of 1\% interest on Overdraft.

Subsidies

Can avail subsidy from NSIC and credit ratings & Eligible for IPS subsidy.

Reimbursement

Reimbursement on the payment made for obtaining the ISO certificate.

Reservation advantages

Reservation of products for exclusive manufacturing by MSME and SSI.

Excise exemption

Avail Excise Exemption Scheme.

Government tenders

Avail exemption while applying for government tenders.

Direct tax

Exemption under direct tax laws.

Bank mortgage

Enjoy easy bank mortgage.

International affairs

Can become a part of International business fairs.

Benefits for States and Union territories

States and Union territories have their own package of facilities and incentives for small scale.

5 Salient Features of Udyog Aadhar

The registration can be done online just with a single click, the person doesn’t have to visit the office personally.

UAM (Udyog Aadar memorandum) can be filed by self-declaration with the details of the enterprise.

It is possible to file more than one Udyog Aadhar with similar Aadhar number.

The filing is done for free.

There is a basic requirement for filing, such as Aadhar number, Industry name, Address, Bank details.

As explained above there are various benefits of getting a Udyog aadhar for your business, along with that filing and registration is also very easy. In case you have any doubt regarding Udyog aadhar registration, you can consult with LegalDocs experts.

Knowledge Center

Knowledge Center

LEAVE A REPLY: