GST Accounting Software

There are various reasons behind business development and its activities. One of them is the unsystematic method of accounting and monetary records of Income. It is necessary that every Company has to manage their Accounts in a proper and specific way for various other bad circumstances. Online GST Software will be helpful for you to handle your books and GST details with ease and run the business without any hassle. This is an Accounting Software that will fulfill anyone and everyone’s need. Be it a small business owner, Individual entrepreneur, CA, a commoner or an e-commerce seller, this GST Software has been designed to suit your needs. This GST Software has all the features right from GST Billing to GST Returns, Error Detections & corrections, and many more.

Functions of Online GST Software

- Simplify GST filing on Online GST software is absolutely free.

- Create and Manage customized professional invoices.

- Online GST software incorporates all necessities identifying with finance.

- There is an arrangement to deal with more than one financial balance.

- There is a framework to track every business or different offices under one specialty unit.

- The product gives you an online stage for various exercises, for example, online installments, checking records,

- It helps to keep an overview record on what do clients purchase, the amount they purchase, charge charged on it, and so on.

- Manage your stock, track items and deduct tedious procedure.

- Assurance of data security.

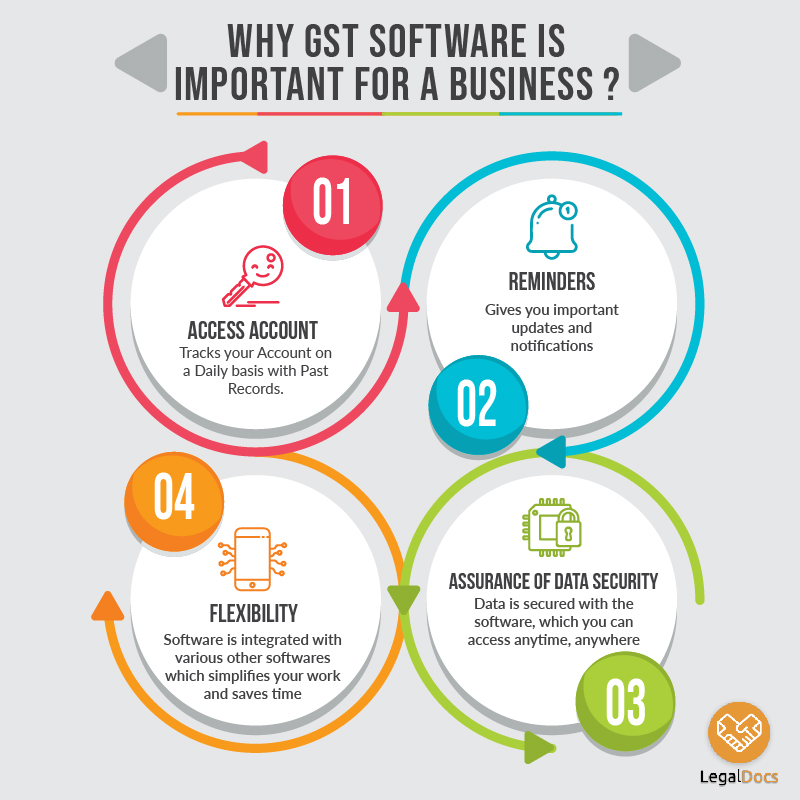

Why Businesses need GST Software?

Access account

Picking GST software that associates legitimately to your organization's ledgers gives you a chance to get to continuous data as required. Programming that associates legitimately to your bank additionally gives you a chance to run point by point reports rapidly. There's no compelling reason to sign into each record independently and track your exchanges by hand. Consider utilizing a cloud-based alternative to appreciate the capacity to get to your monetary data from any area which proves to be useful when you have gatherings with your bookkeeper.

Reminders

GST return filing isn't done once every year thing. As an entrepreneur, you face a few diverse GST due dates to submit required administrative work, for example, reports specifying your deals and buys. It's a great deal to recall, so pick a product alternative that gives you a chance to set up programmed suggestions to keep you over documenting diverse reports and administrative work.

Stock Management

Legaldocs Online GST software will help you to track your products or items, along with that manage stock with a short span of time.

Assurance of Data Security

Data security is the most basic part of the present computerized world. Regardless of how you store your information in the cloud and buy the most costly antivirus software, keen programmers at long last end up taking your information by pushing the whole framework into a threat. In this way, purchasing a sheltered online GST software is a splendid decision to maintain your business in the brilliant light of the new framework.

Flexibility

Several organizations are as of now utilizing some adaptation of an Enterprise Resource Planning (ERP) Software to deal with their business activities and record or report forms. Indeed, even little and medium organizations so far as that is concerned have bookkeeping devices for accounting. In such a domain, setting up new ace information in another application (GST Software) is certifiably not an achievable choice. The GST software must be sufficiently adaptable to incorporate with existing frameworks and give a consistent encounter. Various independent frameworks working in storehouses will just blow up the working expense of organizations.

LegalDocs GST Software Features

-

Absolutely Free

Legal docs Online GST Software helps you to provide the entire service with free of cost, which includes legal knowledge, help from our expertise, understand the procedure in detail, know what is happening in your account and detailed statistics about your business with daily reports.

-

Professional Invoices

Even though the people have stepped in the digital world, but not everyone is aware of the techniques of using accounting and GST registration Online software. So, Legaldocs has introduced a professional invoicing process where you can create and manage customize professional invoices.

-

Stock Management

Legaldocs Online GST software will help you to track your products or items, along with that manage stock with a short span of time.

-

Data Security

Get assurance of data security by keeping the data in your own hands and Legal Docs will make sure that the data is not shared with anyone. You can be able to take complete control of your own data.

-

User-friendly dashboard

Legaldocs introduces an user friendly dashboard which can be accessed by everyone. The dashboard will have detailed information regarding the GST and accounting details. The process to access the dashboard will be very lenient and easy.

Benefits of GST Software

- The GST software makes the entrepreneur mindful about the relevant expense rate they have to pay, to whom and where.

- On account of GST software, small and medium scale organizations can have now access to pre-plan the projects with an additional standard minimal effort.

- When charging and invoicing is mechanized, there is no space for oversights. A wide range of blunders and mistakes that can put your business in a bad position can without much of a stretch be kept away from by fusing GST Software.

- In the event that you are the doing the matter of sending out merchandise and ventures than with GST software you can appreciate more generation and can trade more products with no overwhelming charges.

GST Registration FAQs

What is GST (Goods & Service Tax)?

What is the concept of a destination-based tax on consumption?

Which of the existing taxes are proposed to be subsumed under GST?

a. Central Excise duty

b. Duties of Excise (Medicinal and Toilet Preparations)

c. Additional Duties of Excise (Goods of Special Importance)

d. Additional Duties of Excise (Textiles and Textile Products)

e. Additional Duties of Customs (commonly known as CVD)

f. Special Additional Duty of Customs (SAD)

g. Service Tax

h. Central Surcharges and Cesses so far as they relate to supply of goods and services.

B) State taxes that would be subsumed under the GST are:

a. State VAT

b. Central Sales Tax

c. Luxury Tax

d. Entry Tax (all forms)

e. Entertainment and Amusement Tax (except when levied by the local bodies)

f. Taxes on advertisements

g. Purchase Tax

h. Taxes on lotteries, betting and gambling

i. State Surcharges and Cesses so far as they relate to supply of goods and services

What is the status of Tobacco products after GST?

What type of GST is proposed?

Which authority will levy and administer GST?

What is IGST?

Who will decide rates for levy of GST?

How will imports be taxed under GST?

How will exports be treated under GST?

When did GST come into effect?

Will B2B transactions be subjected to GST?

What is an Input Tax Credit?

How can Input Tax Credits be applied?

CGST input tax credits can only be used to pay CGST and IGST

SGST input tax credits can only be used to pay SGST and IGST

IGST input tax credits can be used to pay CGST, SGST, and IGST

How and when should the returns be filed?

Can we claim GST interest refund after two years of payment?

How does GST apply to business?

Is PAN required to apply for GST?

Is there any specific time period for GST registration?

Who is a Casual Taxable Person?

Who are exempted from GST registration?

Any specialized agency of UNO (United Nations Organisation) or any multilateral financial institution and organization notified under the United Nations Act, 1947 Consulate or Embassy of foreign countries

Any other person notified by the Board/Commissioner

The Central Government or State Government may be based on the recommendation of the GST Council, notify exemption from registration to specific persons.

Is there any provision in GST for the tax treatment of goods returned by the recipient?

Are all goods and services taxable under GST?

What is meant by Reverse Charge?

What is the registration process for GST in India?

Application Drafting

ARN Number

Registered GST Number

Knowledge Center

Knowledge Center